Cost and Management Accountancy (CMA) is a professional certification credential in the management accounting and financial management fields. The certification signifies that the person possesses knowledge in the areas of financial planning, analysis, control, decision support, and professional ethics. There are many professional bodies globally that have management accounting professional qualifications. Coaching for CMA (India) and CMA (USA) are available.

CMA course has three levels which are:

- Foundation

- Inter and

- Final

Eligibility

Foundation Course

- Should have passed Class 10 or equivalent from a recognized Board or Institution.

- Passed Senior Secondary Examination under 10+2 scheme of a recognized Board or an Examination recognized by the Central Government as equivalent thereto or has passed National Diploma in Commerce Examination held by the All India Council for Technical Education or any State Board of Technical Education under the authority of the said All India Council, or the Diploma in Rural Service Examination conducted by the National Council of Higher Education.

Intermediate Course

- Passed Senior Secondary School Examination (10+2) and Foundation Course of the Institute of Cost Accountants of India/ Graduation in any discipline other than Fine Arts/ Foundation (Entry Level) Part I Examination of CAT of the Institute/ Foundation (Entry Level) Part I Examination and Competency Level Part II Examination of CAT of the Institute.

- Passed Foundation of ICSI/Intermediate of ICAI by whatever name called along with 10+2.

Final Course

- Passed the Intermediate course of the Institute and completed 15 months of practical training.

Objectives

- To develop professionals and experts in the area of Cost and Management Accountancy

- To encourage adoption of advanced scientific methods and tools in Cost and Management Accountancy

- To keep abreast of development in Cost and Management Accounting principles and practices, to incorporate such changes as essential for creating value for the industry and other economic activities

- To achieve personal and professional heights in CMA

Opportunities

Cost and Management Accountants (CMAs) have a leading and important role in this new tax regime. CMA Professionals have vast opportunities in the advisory services like Impact Study, Contract Review, Impact on Pricing Model, Business Structure revamping, Supply Chain Management, Logistics and Distribution Systems, Business process mapping,GST etc.

CMA professionals play a crucial role in Maintenance of Cost Records and Cost Audit, Internal Audit, Certification of various forms in Director General of Foreign Trade under the Ministry of Commerce and Industry, Empanelment as Auditors in Co-operative Society, Stock, Concurrent and Due Diligence Audit of various Banks.

Apart from that, Certification of Consumption for import Application, Tax Consultancy, Insolvency Professional, Registered Valuer, Project Management Consultancy, Surveyor and Loss Assessor, Recovery Consultant in Banking Sector, Business Valuation, Financial Services, Advisor, Trustee, Executor, Administrator, Arbitrator, Receiver, Appraiser, Valuer, Adviser

Quick Enquiry

Course Details |

|

|---|---|

| Degree | Special Training |

| Level | Advanced |

| Mode | Blended |

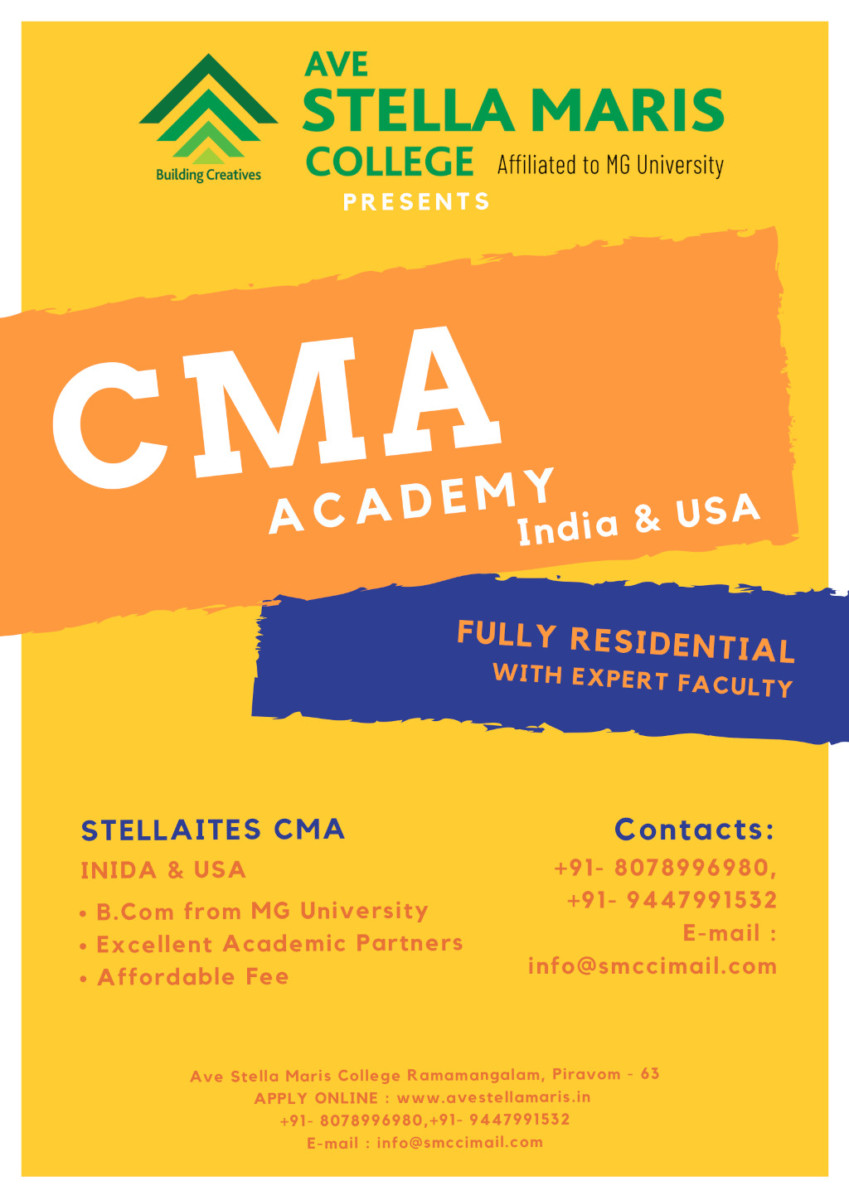

| Accreditation | Stellaites Commerce Academy |

| Medium of Instruction | English |

| Program Duration | Three Years |

Download Course Brochure

DownloadContact Us

Want to know more? Have questions? Please call us on the following numbers or drop us a message.